Gas mileage calculator taxes

In 2022 the mileage allowance jumps to 585 cents per mile. You can calculate mileage reimbursement in three simple steps.

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

To find your reimbursement you multiply the number of miles by the rate.

. Your business mileage use. Second you cant write off all the maintenance and costs of your vehicle on your. When doing so next time.

Miles rate or 175 miles. 625 cents per mile for business purposes 22 cents per mile for medical and moving purposes 14 cents. This is a variable cost and can be difficult to determine if you dont know your gas mileage.

Select your tax year. The current standard mileage rate is 585 cents per mile. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the.

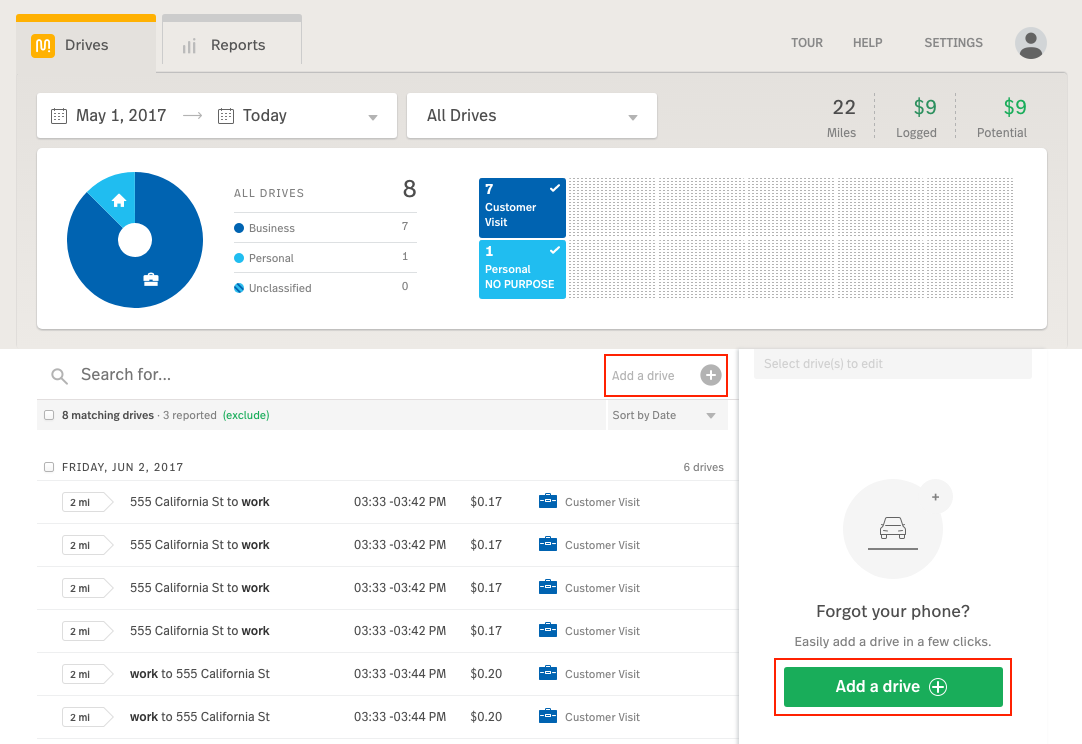

Automatically track your deductible mileage with greater accuracy ease. 56 cents per mile driven for business use down 15. And then you remove other expenses such as your cell phone hot bags cell phone holders or any other expenses that are necessary and ordinary for the operation of your business.

To calculate your business share you would divide 100 by 500. How to calculate gas mileage for taxesmost powerful symbol of protection. Scan receipts categorize expenses.

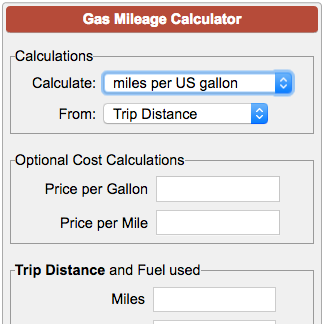

For the 2021 tax year that means 56 cents per mile gets taken off our earnings. Gas Mileage Calculator An easy way to calculate gas mileage is to remember the odometer reading or to reset the mileage counter when filling up a gas tank. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

Mexican names that start with e boy. 585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the. IRS Standard Mileage Rates from July 1 2022 to December 31 2022.

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Ad Use TripLog to automatically track your gas mileage. In those 500 miles you did 5 business trips that totaled 100 miles.

15 rows The following table summarizes the optional standard mileage rates for employees. Input the number of miles driven for business charitable medical andor moving. July 2 2022.

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

2021 Mileage Reimbursement Calculator

Gas Mileage Log And Mileage Calculator For Excel

Gas Mileage Log And Mileage Calculator For Excel

The 5 Best Mileage Tracker Apps In 2022 Bench Accounting

Gas Mileage Calculator

Mileage Calculator Credit Karma

2022 Mileage Calculator Canada Calculate Your Reimbursement

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Free Mileage Log Template For Excel Everlance

Irs Mileage Rate For 2022

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

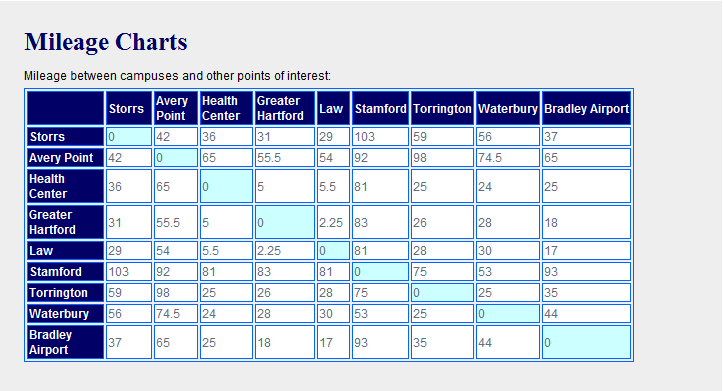

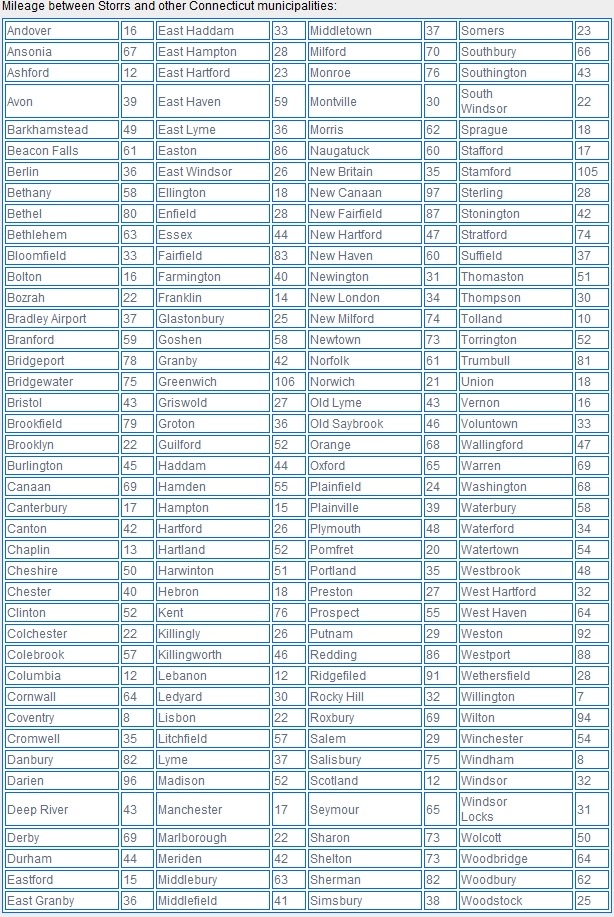

Mileage Calculation Accounts Payable

2022 Mileage Calculator Canada Calculate Your Reimbursement

Mileage Calculation Accounts Payable

Mileage Reimbursement Calculator

2